Sustainability refers to living, doing business and advancing global development in a way that respects human rights, empowers people and values nature. Sustainability requires an inclusive, long-term approach to investing in better solutions that benefit everyone.

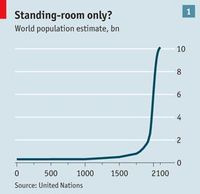

The world’s population has ballooned from 2.5 billion to nearly 7 billion people since 1950, as shown in the chart below from the Economist. To put that in better perspective, it took 250 million years to reach 2.5 billion people, but only 60 years to add another 4.5 million people.

This dramatic population growth has led to unprecedented levels of global consumption and demand for the earth’s limited supply of natural resources. The chart below from the Carbon Dioxide Information Analysis Center (CDIAC) shows the sharp increase in global carbon emissions that has accompanied the dramatic population growth and economic development since 1950.

Sustainability addresses the challenge of aligning the consumption of a rapidly expanding global population with the limitations of the earth’s natural resources and ecosystems.

Sustainability in the News

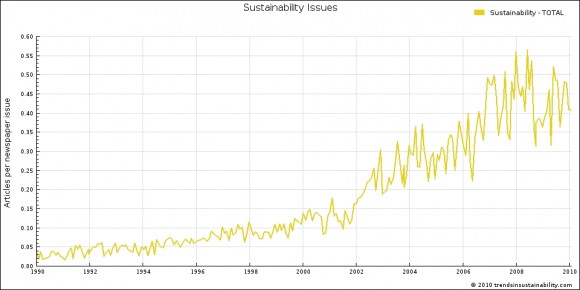

International media coverage reflects the world’s growing interest in sustainability issues. From 1990 to 2010, the term “sustainability” became increasingly common in major newspapers, with usage increasing from 0.05 to 0.45 articles per issue. In other words, articles referencing sustainability went from being largely non-existent in 1990 to appearing in nearly ever other issue of daily newspapers around the world by 2010.

Three Pillars of Sustainability

Sustainability is an inclusive, collaborative concept that focuses on the linkages between three key pillars: environmental, economic and social.

Environmental Sustainability

Sustainability calls for thoughtful conservation of the earth’s climate, natural ecosystems, biodiversity and finite supply of natural resources.

The earth’s natural environments provide a host of vital ecosystem services, including the supply and replenishment of fertile soil, clean water, timber and other raw materials. These services are especially critical to the livelihoods of billions of rural and poor people, many of whom rely on subsistence agriculture and live directly off the land.

Unsustainable commercial activities, ranging from the extraction of natural resources to tourism, can damage or even destroy natural ecosystems and the services they provide. Manmade countermeasures are often very expensive and time-consuming and rarely as effective. For example, natural mangrove forests tend to be far better at protecting tropical coastlines and coral reefs than costly retaining walls. By restoring a degraded natural ecosystem, New York City resolved its water quality issues and saved $8 billion that would have been required to build a water treatment facility.

Recognizing the Value of Natural Capital

Fortunately, a number of important efforts are working to quantify the value of natural ecosystem services and incorporate them into core business practices. For example, environmental organizations like the The Nature Conservancy are collaborating with leading multinational companies on developing approaches to factoring the value of nature into business strategy and decision-making.

The Group of 8 leading industrialized nations initiated the Economics of Ecosystems and Biodiversity (TEEB) project to study the economic impact of ecosystem services and changes in biodiversity. The TEEB study puts the annual value contributed by global wetlands at $3.4 billion and the annual loss of natural capital from ecosystems like forests at $2 to $4.5 trillion.

Sustainable Capitalism and the Triple Bottom Line

Sustainable capitalism is an outgrowth of the interest in sustainability and concerns about the implications of the narrow economic priorities of the corporate sector and international financial system.

To date, investors and managers have largely focused on and been held accountable for short-term financial results. Sustainable capitalism and the triple bottom line take a more integrated, longer term approach to assessing a company’s value and contribution to society. In keeping with the three pillars of sustainability, corporate performance and investment opportunities are evaluated not just on the basis of economic profits and assets but in terms of the combined effect of a company’s economic, environmental and social impacts.

ESG – Environmental, Social and Governance Issues

CalPERS, a member of Ceres’ Investor Network on Climate Risk (INCR), is one of a number of influential institutional investors that are working to incorporate sustainability into their investment criteria. Formally known as the Investment Committee of the California Public Employees’ Retirement System, CalPERS is the largest U.S. public pension fund with approximately $220 billion in assets. Since 2010, CalPERS Investment Office has been developing a plan to implement environmental, social and governance (ESG) issues into its investment decision-making across all asset classes.

Fortunately, proponents of sustainable capitalism have more than good intentions and moral high ground on their side. They can point to a growing body of encouraging data suggesting companies that pay attention to environmental and social impacts also often have better financial performance to show for their efforts.

Related articles and content:

Sustainability and Equity: UNDP Human Development Report (HDR) 2011

Sustainability Quiz: Human Development Report 2011

The Great Global Water Squeeze

How Green are the World’s Cities?

Beijing Air Pollution Exposes China’s Health & Environment Risks

News Trends in Sustainability and Development Issues

BRIC Countries Top Survey of Green Consumers

Biodiversity and Ecosystem Services Save Lives and Livelihoods

Global Sherpa topic pages and country profiles: Sustainability, Globalization, Developing Countries, BRIC Countries, India, China, Brazil